Need for gender balance on boards to ensure both sustainability and financial performance

Women participating on management boards is a necessity to ensure corporate sustainability practices. A new study from Halmstad University shows the minimum threshold for firms in Europe. In his PhD studies, Fazle Rahi uncover macro and micro business environmental factors that might affect the nexus between corporate sustainability and financial performance.

Photo: Istock

“In Europe having at least 30 percent of women in the management board is suggested to ensure a synergetic impact towards sustainability.”

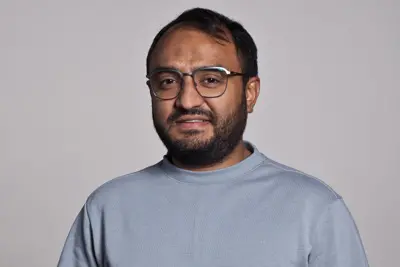

Fazle Rahi, PhD

There is a need for gender balance on management boards, emphasises Fazle Rahi, who recently defended his PhD thesis at Halmstad University

“Women's participation on management boards ensures corporate sustainability practices, literature review from the European context show that,” he says.

The reason is women tend to think more about different stakeholders and society in a broader sense, than their male counter parts. In this study, Fazle Rahi empirically shows the minimum threshold point of women's participation on management boards toward corporate sustainability practices.

“In Europe having at least 30 percent of women in the management board is suggested to ensure a synergetic impact towards sustainability.”

Market reaction

The research also reveals that a higher threshold of women on boards participation caused negative reactions from investors, thus reducing a firm’s market value.

“While doing this research, I got a signal that there is a market reaction above this 30 percent threshold. I recommend further research to fully reveal the market reaction,” says Fazle Rahi.

Fazle Rahi, Halmstad University.

In the USA and other Anglo-Saxon countries share prices seem to go down if there are more women who participate in the management boards. It is purely economic rational. The mindset of the shareholders argues that a higher participation of women affects their investment.

“In Europe, particularly in Western Europe, countries are more influenced by capitalist countries such as the USA and other Anglo-Saxon countries in terms of business operations, management, and other business-related activities,” says Fazle Rahi.

“Shareholders mainly think of themselves, and they are afraid they won’t get their invested money back soon enough if too many women participate on the board.”

Different in Nordic contries

The study is based on data from 440 companies in 19 European countries, among them Denmark, Finland, Norway and Sweden. Fazle Rahi argues that the minimum threshold is probably higher in Sweden and the other Nordic countries, by maybe around 40 percent.

“In Norway, a 40 percent mandatory women participation is required, and other Nordic countries might exhibit a similar trend, without having the requirement. Shareholders’ expectations in these countries are different compared to the rest of the world.”

The bigger scope of the thesis is issues related to sustainability in relation to accounting and financial performance specifically regarding European firms. The focus was to uncover macro and micro business environmental factors that might affect the connection between corporate sustainability and financial performance. On the micro level, the proportion of women on management boards is one of the factors.There are more factors that lie within the micro level, such as slack resources, management adroitness, and strategies toward sustainability, among others.

“In the macro business environment, the link between corporate sustainability practices and financial performance is transformed and shaped through an interaction of the trajectories of multiple actors in the macro business environment.”

There is a need for mutual interaction between actors which include government institutions, corporations and other major stakeholders.

“An effective governance framework for sustainability is affected by rule of law, political stability, control of corruption, GDP per capita, economic growth, inflation and so forth.”

It is not enough

Fazle Rahi’s research is mainly about the European market, but some overall results stand out:

“Europe is doing well, but on a global level the sustainability work is not enough. From the literature search, it is well known that sustainability issues are deliberately underestimated by companies in the more capitalist countries, especially companies from the USA and Anglo-Saxon countries.”

The reasons, argues Fazle Rahi, is a lack of implications from macro business environment in these countries.

“I was surprised to see that some countries such as USA and Anglo-Saxon countries, are not up to the level because the lack of effective macro governance frameworks for sustainability. In those countries, there is a lack of communication between macro and micro business actors on the issue of sustainability.”

Text: Kristina Rörström

Photo: Istock and Magnus Karlsson

More about the research

Fazle Rahi’s PhD thesis:

Nexus between corporate sustainability and financial performance External link, opens in new window.

Fazle Rahi’s doctoral study is jointly financed by Halmstad University and University of Gävle.

The PhD thesis is based on four different studies, were all of them have been published in scientific journals.